AI Is Rewriting the Growth Playbook: Are You Ready?

Using AI as a capability is already considered “table stakes”. I don’t know any organisation that say they are not using AI in their company. However, there is a huge difference in revenue growth trajectories between being an AI-native and AI-augmented company.

An AI-native business is one that is built from the ground up with artificial intelligence at its core, meaning its products, services, and operations would not function or scale effectively without AI. Examples include: OpenAI (AI infrastructure and models), Wayve (transport) and PathAI (healthcare). These companies design their business models around continuous data collection, automated decision-making, and self-improving systems that get smarter with every interaction. In contrast, a traditional non–AI-native business may still use AI for efficiency gains such as improving marketing, forecasting demand, or detecting fraud, but the company could continue to operate without it. In these cases, AI acts as an enhancement or augmentation of existing processes, rather than the foundation of how the business creates and captures value.

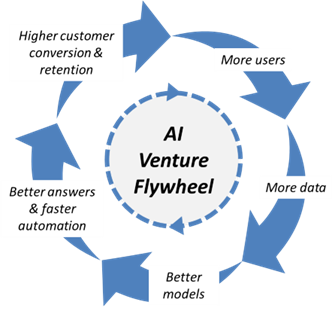

One of the most important differences is that an AI-native company is built to capitalise on a compounding data network effect, or the “model-usage flywheel”, whereas an AI-augmented company do not “naturally” obtain this growth effect. See below for an illustration of this flywheel:

In addition to the above flywheel, the AI-native venture’s growth advantage is driven by three other aspects:

- Near-zero marginal cost automation core workflows, where the AI-native product replace (not just assist) key steps such as intake, decisioning, drafting and QA, so that incremental workload barely adds costs. This drives exponential growth as capacity scales with compute, (not headcount as with the AI-augmented product), new customers onboarding friction drops and improvements enable rapid bottom-up adoption.

- Hyper-personalisation and proactive agents, where AI agents adapts flows, prompts, and content to each user/account context (portfolio, risk, goals, compliance history) and proactively surfaces next best actions. This drives exponential growth as more precise and better personalisation drives faster time to value for customers, which then drives more customers to use the product for more “jobs to be done”.

- Platform and ecosystem effects, where the AI-native product exposes agent APIs, tool-calling, and event streams so ecosystem partners can build adjacent, but connected, products and templates on the AI-native venture platform that attract more users – thereby creating a two-sided networking growth effect.

Why is this important? Well, it has a huge impact for driving profitable growth and avoiding being disrupted in the near future by smarter, cheaper and faster competitors. How this works can be illustrated using a realistic investment scenario.

Growth Scenario Analysis

Imagine a software company in the Health Tech sector having a strategic offsite. The purpose of this gathering is for the executive team to explore how they can accelerate their business growth and avoid being disrupted by AI-native competitors. Their existing SaaS business is experiencing almost zero year-on-year annual revenue growth, and the operating margin has been compressed to low double digits. Their Rule of 40 metric is below 20. The share price is slowly declining, and the company expects a PE firm will soon be showing an interest in buying the company, applying a turn-around plan for the business. Most analysts have a Hold or Sell recommendation on the stock and the P/E ratio mirrors an infrastructure company valuation rather than ratios typically assigned to a software company. Something needs to change.

The company Board has challenged the executive team to provide a credible way back to high-margin growth and delivering a Rule of 40 outcome in 3 years. The executive team is aware that there is a global surge in demand for accessible, personalised healthcare solutions, driven by aging populations and rising chronic illness, and that AI is a game-changer to lower the cost of care delivery while scaling access to high-quality health services with affordable health insights, diagnostics, and treatment pathways, i.e., focusing on patients who cannot afford or access current high-cost healthcare solutions. They decide to explore two alternative growth options:

- Augmenting the existing SaaS solution with AI product features, or

- Building a new AI-driven venture, whilst maintaining the existing SaaS solution.

The CFO has run the numbers on how much the company can afford to invest in the near term, and consensus among the executive team is that the company can only afford to pursue one of these strategic options.

To make an informed decision, they use the latest AI / LLM assistant to construct a high-level financial model of both options.

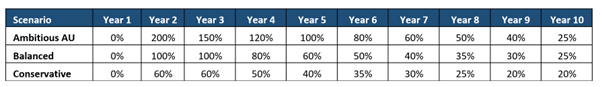

Using a 10-year investment horizon, an objective to launch a $10 per user per month health insight solution that can be used by both B2B and B2B2C, they construct revenue scenarios to ground the conversation. To better understand the sensitivity of the AI-native ventures growth, they use 3 scenarios, each with different year-on-year revenue growth metrics:

The AI-augment product’s growth is assumed to be 20% year-on-year, and they also decide to increase the price by 2% above CPI every year (CPI assumed to be 2.5%).

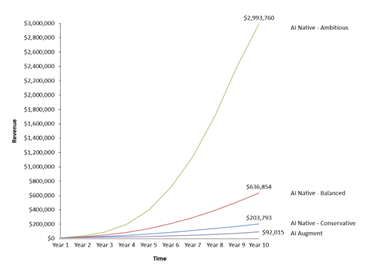

The chart below shows the three AI-native product scenarios and the A-augmentation scenario revenue growth over 10 years (Note 1):

The above chart shows that even the Conservative AI-native scenario exhibits a 121% difference in revenue by Year 10 to the AI-augmentation scenario. The Ambitious scenario may be modelled too aggressive (although plenty of recent AI-driven companies have achieved higher growth rates), and the Balanced scenario is perhaps more realistic and achievable. In this latter scenario, the AI-native venture still shows an almost 600% difference in revenue by Year 10 when compared to the AI-augmentation strategy.

In addition to the above comparison, the modelling illustrates important strategic growth considerations:

- Within 3 years the AI-native ventures will outperform AI-augmentation significantly on revenue growth.

- The AI-native venture exhibits initial “stealth mode growth”. The AI-augmentation companies may not initially notice the difference in market share, but by the time they do, it is too late as the AI-native venture’s growth is using the law of compounding data network effects.

- By year 5 it’s all over, the AI-native venture has an unassailable cash generating advantage, that can be re-invested in the AI-driven business, making it almost impossible for that AI-augmented company to ever catch up.

Final Notes

The above AI venture flywheel and revenue scenarios illustrate why building an AI-native venture generally is the shortest path to highest impact investment, when compared to an alternative of augmenting existing products with AI features. That doesn’t mean building an AI-native venture is easy, and there are many challenges along the way as most founders can attest to. But building an AI-native venture is the best way forward if you want to avoid being disrupted by AI-natives within the next 3 years.

Note 1: Naturally, in a financial scenario model both revenue and costs must be considered. Future Technology Connect articles will explore the cost side of the growth equation.

If interested in exploring how you could benefit from building your AI-native Venture, then connect with us.

Tom Dissing is the founder and Managing Director of Technology Connect. He helps boards and executives drive growth and avoid disruption through artificial intelligence (AI), innovation and venture building

Copyright © 2025 Technology Connect. All rights reserved.