Ambidextrous AI Venture Strategy: Protecting the Core and Winning the Future

A Board‑Level Blueprint

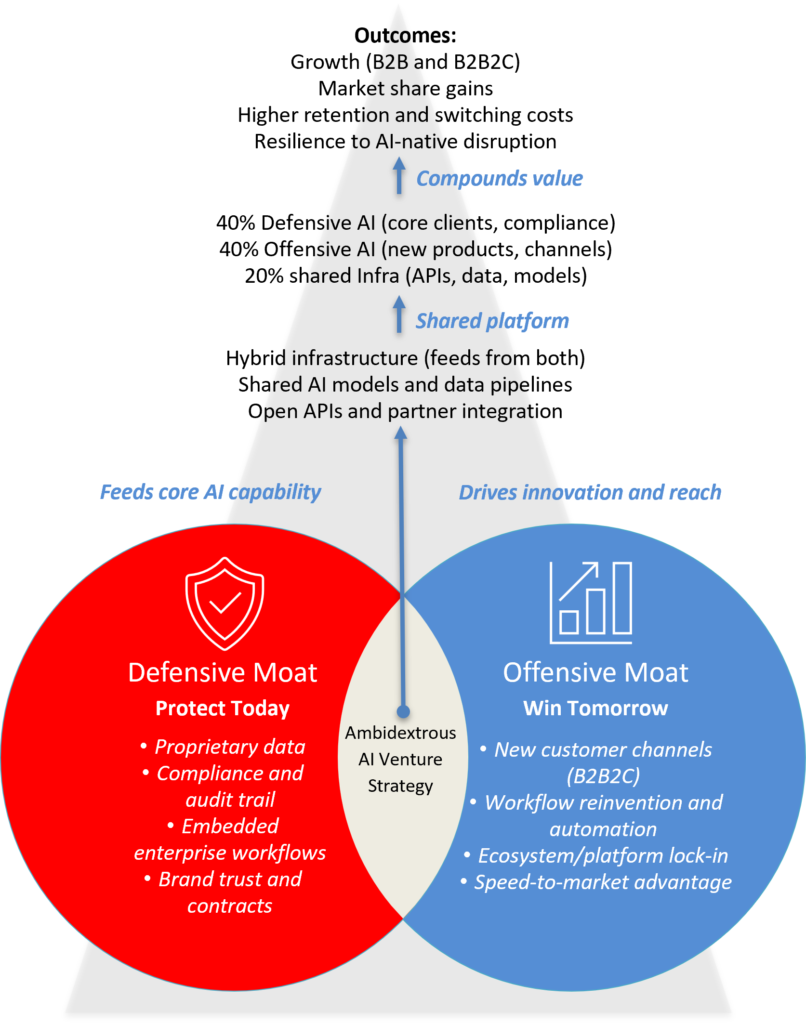

In today’s AI-driven economy, Boards and executives face a paradox. They must protect and optimise their existing business while simultaneously building disruptive, AI-enabled growth engines. This dual imperative is not optional. The companies that master both will define the competitive landscape as a leader in their ecosystem for years to come. This is the essence of an Ambidextrous AI Venture Strategy.

Why Ambidexterity Matters Now

AI-native competitors are not constrained by legacy systems, entrenched operating models and slow investment decision making processes. They move quickly through rapid experimentation and daily product updates to continuously redefine customer expectations.

Yet mid-sized incumbent companies hold assets that are far more valuable than most realise: Proprietary data, comprehensive distribution channels, established customer relationships, regulatory approvals, and integrated workflows (APIs). The challenge is turning these assets into a competitive advantage while also moving into new spaces before disruptors do.

The Two Strategic Tracks of an Ambidextrous AI Venture Strategy

An ambidextrous approach to AI venture building runs on two parallel tracks a Defensive and Offensive as illustrated in the diagram below:

Ambidextrous AI Venture Strategy

Three Principles for Boards and Executives

- Do not treat defence and offence as competing priorities – they must be pursued in parallel whilst tracking both moat strength and revenue growth as equal measures of success

- Ringfence data and compliance assets while finding ways to monetise them through AI

- Establish a separate venture vehicle, i.e., a Venture Factory, or governance model to enable faster experimentation

From Concept to Execution

The most effective ambidextrous AI venture strategies start with a clear asset inventory and a realistic assessment of competitive threats. From there, leadership must design a portfolio of new AI-driven initiatives – some aimed at strengthening the core, others aimed at market capture through new ventures. Both must be underpinned by shared infrastructure such as AI models, APIs, and data pipelines. Execution requires an innovation culture, investment governance discipline, and the willingness to make bold bets while managing downside risk.

Boards and executives who embrace ambidexterity will not only shield their organisations from AI-driven disruption but also position them as ecosystem leaders in defining the future. In the AI era, success belongs to those who can protect today while building tomorrow.

If interested in exploring how you could benefit from building your Ambidextrous AI Venture Strategy, then connect with us.

Tom Dissing is the founder and Managing Director of Technology Connect. He helps boards and executives drive growth and avoid disruption through artificial intelligence (AI), innovation and venture building

Copyright © 2025 Technology Connect. All rights reserved.