From Humans to AI Agents: The Silent Shift Reshaping Every Investment Committee Agentic AI Decision

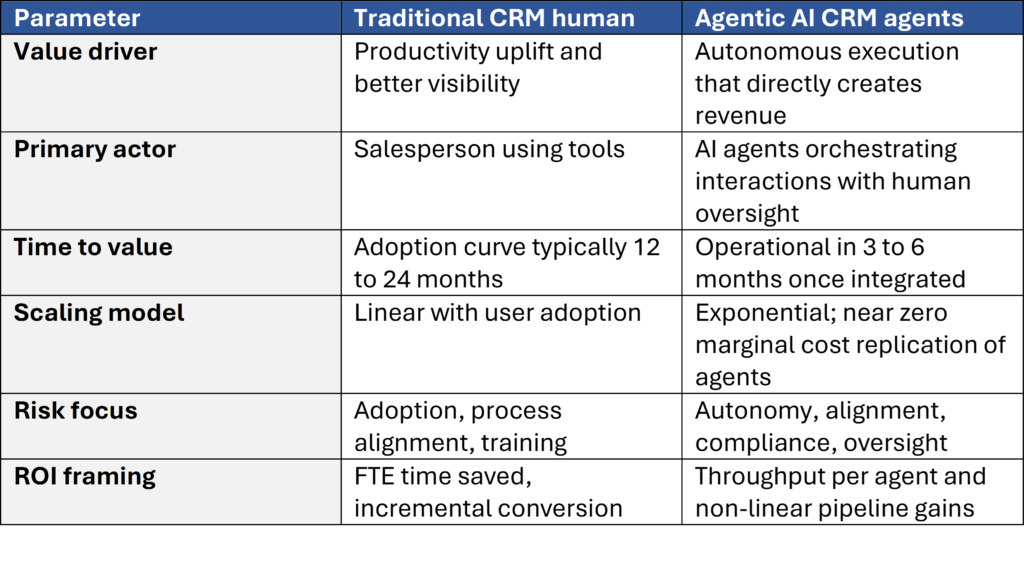

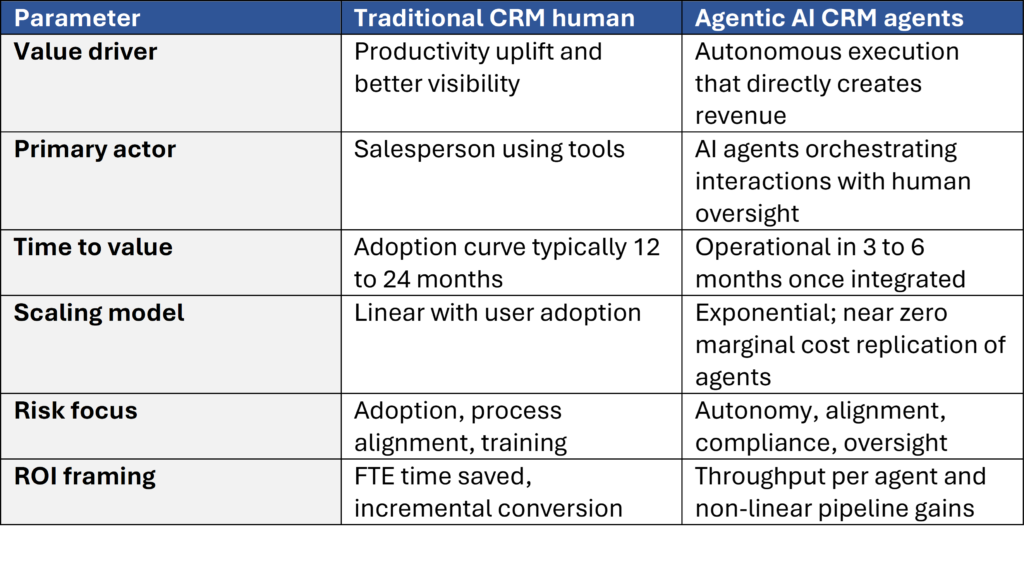

Agentic AI shifts the centre of gravity in investment cases from people enabled by tools to autonomous agents executing work at scale. This has material implications for value creation, operating model, risk and cost. The decision lens must move from adoption and training to autonomy, governance and value realisation.

Two paths to the same outcome increase sales revenue (CRM use case):

- Traditional CRM path: Invest in a CRM to centralise customer data, standardise pipeline management and improve salesperson productivity. Value is realised when people adopt processes and spend more time selling.

- Agentic AI path: Deploy sales agents that qualify leads, orchestrate personalised outreach across channels, draft proposals and update forecasts automatically, escalating to humans only for judgment calls. Value is realised when agents generate throughput autonomously and humans supervise exceptions.

How the investment logic differs

Cost profile what changes and why it matters

Cost profile what changes and why it matters

Traditional CRM costs are predictable and largely tied to headcount. Licenses, implementation and integration, user training, administration and support are contracted and scaled linearly with the number of users.

In contrast, Agentic AI costs are driven by agent volume and behaviour rather than seats. They can be tightly controlled, but only with upfront guardrails and continuous monitoring.

Key Agentic AI CRM cost breakdown and control levers

What the Investment Committee must ask before approval

What the Investment Committee must ask before approval

- How predictable and controllable are run rate costs as agents scale and what safeguards are in place to cap spend?

- What is the unit cost per outcome, for example cost per qualified lead or cost per 100 tailored outreach messages?

- What budget guardrails exist per agent per day with automated throttling, and how are they monitored in real time?

- How does the ROI model behave under best case, expected, and worst case spend scenarios?

- What kill switches and escalation paths trigger when compliance errors or spend anomalies occur?

Bottom line

Agentic AI can accelerate revenue faster than tool centric investments, but it demands different governance. To gain speed and scale without losing accountability, treat agents as the primary actors, measure throughput and outcomes, and enforce budget controls by design.

Tom Dissing is the founder and Managing Director of Technology Connect. He helps boards and executives drive growth and avoid disruption through artificial intelligence (AI), innovation and venture building

Copyright © 2025 Technology Connect. All rights reserved.