Redefining Performance in the AI Era

Redefining Performance in the AI Era

The new performance frontier for AI-enabled firms

Artificial intelligence is reshaping the rules of competition, but contrary to popular belief, the true battleground isn’t technology itself – it’s performance. In an era awash with powerful algorithms and endless pilots, companies are learning a hard truth: simply deploying AI solutions means little if they don’t translate into better outcomes. Performance – not technology – has become the central strategic goal of AI transformation. Organisations that thrive are those that harness AI to dramatically improve productivity, learning, speed and innovation, not just those that accumulate the most algorithms.

Performance Over Technology: AI’s Strategic North Star

Every technological revolution in business eventually comes down to one question: does it make us perform better? AI is no exception. Amid the excitement of deploying machine learning models, generative AI or AI agents, leaders are realising that technology for technology’s sake is a dead end. The organisations pulling ahead are those treating performance gains as the primary objective of AI initiatives – using the technology as a means to an end (better outcomes), not the end itself.

Many boards invest in AI hoping to boost knowledge-worker efficiency, but without a structured plan to realise value; tools are deployed but value is not realised. Success with AI requires starting with a performance mindset – defining, or at least hypothesising, upfront how an AI solution will change outcomes like productivity, quality, or speed, and then rewiring roles and processes to capture that “productivity dividend” in the P&L. In practice, this means AI at scale must be treated as a business transformation, not a series of software integrations.

Leading companies are therefore making performance impact their North Star for AI. They structure AI programs under executive sponsors who tie projects to strategic goals and measurable results. They avoid piloting AI in isolation; instead, they plan from day one how new AI capabilities will embed into workflows, how employees will adopt them, and how value will be tracked. This focus on performance is not anti-technology – it’s what ensures technology actually matters.

Redefining Performance in the AI Era

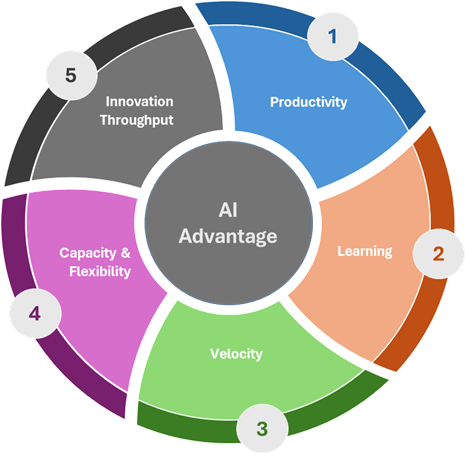

What does “performance” mean in an AI-driven organisation? Traditionally, we measured performance with straightforward efficiency and financial KPIs – output per worker, profit margins, growth rates, etc. Those measures remain important, but the AI era is expanding the very notion of performance. Leading organisations now define performance as a multidimensional, continuously evolving target that blends productivity with less tangible but critical capabilities like learning and innovation. As illustrated in figure 1 below, five elements form the new performance frontier for AI-enabled firms creating and sustaining an AI advantage: productivity, learning, velocity, capacity & flexibility, and innovation throughput.

Figure 1: AI Performance Measurement Framework

Source: Technology Connect

Productivity: AI’s first and most immediate contribution is often in productivity – automating routine work, augmenting employees’ capabilities, and removing bottlenecks. In the AI era, productivity gains are not incremental but exponential. A single AI-driven system can do the work of dozens of people or empower one employee to have the impact of many.

Learning: Perhaps the most defining feature of AI-enabled firms is that they are “learning engines”. They treat performance as a moving target, constantly improved through data feedback loops and experimentation. In the AI era, a company’s ability to learn quickly – at the individual, team, and organisational level – is a core driver of performance. This goes beyond training programs; it means the organisation as a whole adapts and gets smarter with each AI use case and project.

Velocity: Traditional performance metrics often looked at quarterly or annual outputs. In the AI era, time has become a key performance variable – specifically, how fast an organisation can move from idea to insight to implemented result. “Velocity” in this context means the sheer speed of decision-making, execution, and iteration. AI can compress processes that previously took weeks into days or hours.

Capacity & Flexibility: AI transformation fundamentally changes the economics of scaling a business. When software and algorithms handle core processes, companies can grow with far fewer incremental costs or people. Performance in the AI era thus includes an almost limitless capacity to expand operations and enter new domains – if the models and data support it.

Innovation Throughput: Finally, AI is turbocharging innovation itself – not just in tech companies, but across industries. Innovation throughput refers to the rate at which an organisation can generate, build, test, de-risk, and implement new ideas or improvements. In the past, innovation was often constrained by human bandwidth and lengthy R&D cycles. AI changes that by automating parts of research (for example, scanning vast data for patterns), by enabling simulation and virtual experimentation, and by facilitating rapid prototyping (think AI-assisted design). The result is that a company’s “innovation engine” can run much faster.

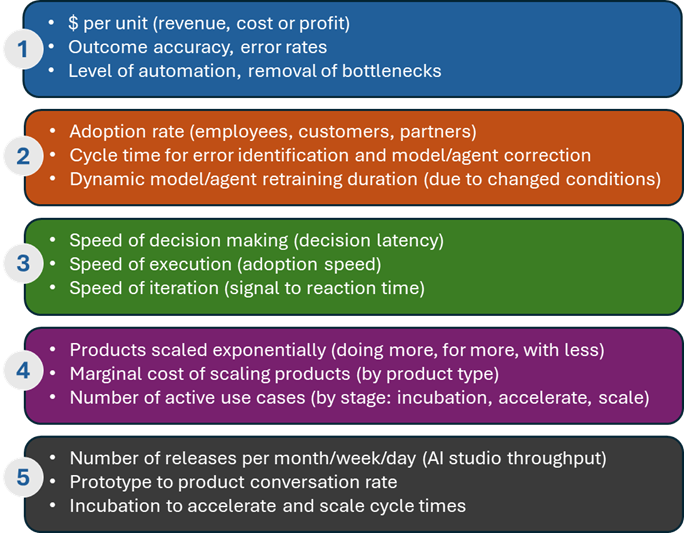

As an example of how to operationalise the AI Performance Measurement Framework, Table 1 below provides an example of AI performance metrics across the five dimensions:

Source: Technology Connect

In Summary

In blending these five dimensions, performance in the AI era becomes a rich tapestry. It’s no longer captured by a single metric on a monthly report. A truly high-performing AI-driven organisation might be, for instance, simultaneously cutting manual effort by 30%, doubling its speed of feature development, scaling to serve 5x more customers, and learning from every interaction to refine its services. These facets reinforce each other: increased capacity enables more data and learning; faster velocity enables more innovation experiments; innovation creates new revenue that boosts productivity metrics, and so on. Importantly, some of these elements (like learning and innovation) are more intangible – they may not show up in traditional quarterly numbers, but they are what ensure the organisation’s performance keeps improving over time. Executives, therefore, must expand their mental model of what to monitor and manage to create and sustain an AI advantage.

If interested in exploring how to develop or refine your organisations AI Performance Measurement Framework, then connect with us.

Tom Dissing is the founder and Managing Director of Technology Connect. He has deep expertise in helping companies digitally transform and scale their businesses through better, faster and smarter use of emerging technology and optimising value from ecosystems of supplier capabilities. Tom is a trusted advisor to procurement, technology and finance executives and senior management teams. He has advised senior executives in Financial Services (Banking, Insurance, Wealth and Superannuation), Media & Entertainment, Construction & Engineering, Technology Services and Government (Federal and State) in Australia, New Zealand, Asia and Europe.

Copyright © 2025 Technology Connect. All rights reserved.